QuantFi, in collaboration with QURECA are pleased to announce the launch of their first online course, “Introduction to Quantitative and Computational Finance”.

Quantitative Finance – the use of mathematical models and extremely large datasets to analyse financial markets and securities. Common examples include the pricing of derivative securities such as options, and risk management, especially as it relates to portfolio management applications. Professionals who work in this field are often referred to as “Quants.” The Corporate Finance Institute [1].

As a concept, quantitative finance is relatively new, born of the first financial computing revolution and driven by applied mathematics PHD’s trained in the early 70s, it has now expanded to include a multitude of disciplines, all of which seek use to data to guide investors to make profitable decisions.

Providing significant advantages when applied to portfolio management and investment strategy, the demand for quantitative analysts continues to grow; a trend is set to continue as the use of computation in the finance industry increases – amplified by the transformative potential of quantum computing methods.

These positive benefits have fuelled ‘Quantitative Funds’, investment firms where financial decisions are determined entirely by numerical methods rather than by human judgement [2]. Investment decisions informed by quantitative financial models now play an important part in the investment strategies of firms such as D.E. Shaw group and AQR Capital Management who have US$50billion [3] and US$140billion [4] of assets under management respectively. Now is the best time to master a new skill and enter the world of Quantitative Finance. A career that is highly stimulating and situated at the cutting edge.

Developed as part of the specialised program, “Quantum Computing for Finance”, why not then take your first step forward and build the fundamentals needed to help you stay ahead of the second computing revolution by starting now with QuantFi, in partnership with QURECA, who bring you an “Introduction to Quantative and Computational Finance“ – a comprehensive introductory course designed specifically for all those who wish to broaden their skillset and begin a career in quantitative finance.

The course is not restricted only to those with a mathematics background, but all potential learners should have prior knowledge of the following content areas, either through the competition of academic studies or relative professional preparation:

- Basic calculus (partial derivatives)

- Probability theory (with an exposure to measure theory if possible)

- Basic linear algebra (including matrix operations)

- Numerical Python (NumPy is essential)

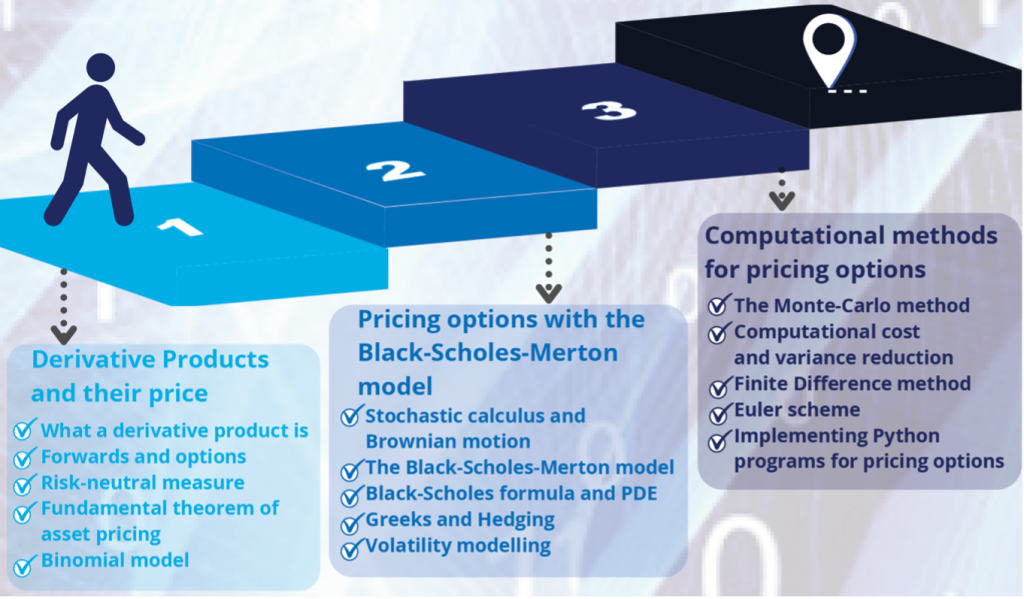

Module one will introduce you to derivative products and their pricing, the risk-neutral pricing framework, and options pricing with the Binomial model. In module twoyou will explore stochastic calculus according to Itô, as well as the Black-Scholes-Merton model, which will be applied to the example of European calls. The module will conclude by addressing hedging and the problem of volatility, with detail given on differing model parameters, known as the Greeks. In the final module you will learn to define the Monte-Carlo method, implementing it in Python to price a European call, as well as gaining an understanding of how to discretise the stochastic differential equation (SDE), utilise the Euler-Maruyama method, and apply two Finite Difference Methods for pricing European options.

By the end of the course, you will have a strong foundation in modelling and building algorithm which you will be able use to solve complex financial problems by applying emerging cutting-edge computational technologies.

Every course you take on QURECA includes the relevant certificate without any additional cost. QURECA is accredited to deliver certificates by the CPD Certification Service, and guarantees that you are globally certified.

Start learning and enrol now – GOTOCOURSE

QuantFi.

QuantFi is a grassroots start-up that champions young post-graduate scientists creating solutions for complex financial problems. QuantFi creates intellectual property in Quantum Computing for Finance through the creation of computer algorithms designed to make financial analysis not only faster but more accurate and predictive. The current focus of the business is on the following three types of use cases:

• Portfolio Management

• Derivative Pricing and Risk Management

• Trend Detection

QURECA Ltd.

In 2019, the Royal Society described QURECA Ltd. as the company that “fills the gaps in the existing quantum community, creating a society ready for quantum through a common language.”

QURECA provides a range of professional services, business development, and the solution to the quantum workforce skills bottleneck. QURECA is the first online platform for quantum training and resourcing, to support individuals and businesses to be part of the quantum revolution.

References.

[1] The Corporate Finance Institute (no date) ‘What is Quantitative Finance?’ – https://corporatefinanceinstitute.com/resources/knowledge/finance/quantitative-finance/

[2] M. A. H. Dempster, G. Mitra, and G. Pflug. (2008) Quantitative Fund Management, Boca Raton, Florida: Routledge & CRC Press.

[3] https://www.ft.com/content/1cbdb07a-4061-11e9-b896-fe36ec32aece

[4] https://www.bloomberg.com/news/articles/2019-04-02/aqr-annual-profit-plunges-34-in-rough-environment-for-quants